Here are some charts of the Euro/Usd, the first one is the daily chart, then the 4hour chart and then the 1 hour chart. I will look over the 3 times lines to before any trade is took unless its a very short term daily trade then all I will do is look at the 4hr and 1hr times and see if everything lines up well.

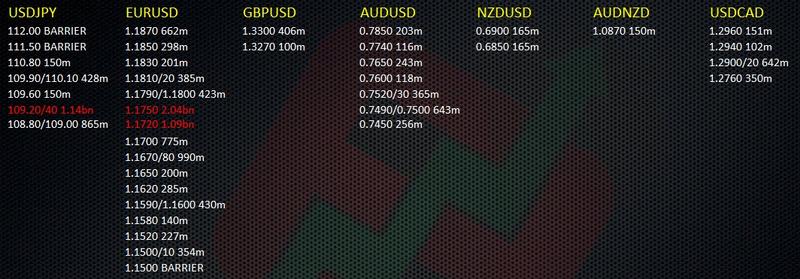

Normally you can mark whats happening on the day on the chart line options, bids,offers and any heavy money being injected into the market. Once you way up the information you can start planning your trade with the higher probability is on the side of the trade your going to take. You have to ask yourself why is this trade worth taking, can show why its cheap and needs buying or expensive and needs selling either short term or long term. If you cant answer these questions you shouldn't take the trade but if you can and you can define risk and limit this by using certain tools then the trade is worth taking.

I don't normally have a set TP (take profit) but I will have an area were I will be looking at closing the trade out, it will all depend on how the trade is working out because this market is moving all the time and its very organic and things can change easily which may effect your trade so many times I will manage the trade unless I am going for a medium term or longer term view, then you can set the trade up take it and leave it until your SL or TP is hit. I trade both styles but much prefer shorter term trading because news can completely wipe out your analysis and take the price off into a completely different direction, so monitoring or setting alerts is the way forward.

Reply With Quote

Reply With Quote